Pinetree Capital Ltd Announces Unaudited Financial Results For The Period Ended June 30, 2022

ACCESS Newswire

12 Aug 2022, 04:20 GMT+10

TORONTO, ON / ACCESSWIRE / August 11, 2022 / Pinetree Capital Ltd. (TSX:PNP) ('Pinetree' or the 'Company') today announced its financial results for the three months ended June 30, 2022. All financial information provided in this press release is unaudited and all figures are in $'000 except per share amounts and shares outstanding.

Unaudited financial results for the period ended June 30, 2022

The following information should be read in conjunction with our annual audited Consolidated Financial Statements, prepared in accordance with International Financial Reporting Standards ('IFRS') and our annual Management Discussion and Analysis for the year ended December 31, 2021, which can be found on SEDAR at www.sedar.com.

Selected Financial Information

1 Refer to 'Use of Non-IFRS Financial Measures'

Shares Outstanding and Equity amounts are as at the Quarter End date. Expense amounts are for the Three months ending the Quarter End date

As at June 30, 2022, Pinetree's equity was $37,644 as compared to $38,439 as at December 31, 2021. This resulted in Pinetree's BVPS decreasing from $4.09 as at December 31, 2021 to $4.01 as at June 30, 2022. The change represents a decrease of $0.08 or 2% in the year to date.

As at June 30, 2022, the Company held equity investments at fair value totaling $28,190, which represented 75% of book value. This compares to equity investments at fair value of $24,703 representing 64% of book value as at December 31, 2021.

Earnings per share for the three months ended June 30, 2022 was $0.20 compared to earnings per share of $0.04 for the three months ended June 30, 2021.

Expenses for the twelve months ended June 30, 2022 were $1,056 which corresponds to 2.8% of book value as at June 30, 2022. This compares to expenses of $922 for the twelve months ended December 31, 2021 which corresponds to 2.4% of book value as at December 31, 2021. Included in expenses are foreign exchange fluctuations resulting from cash balances held in currencies other than Canadian Dollars. Since expenses fluctuate from quarter to quarter, management monitors costs on a trailing twelve-month basis.

The net investment gains for the three months ended June 30, 2022 were $2,013 (three months ended June 30, 2021 - gains of $397) as a result of net realized gains on investments and the net change in unrealized gains.

For the three months ended June 30, 2022, other income totalled $82 as compared to other income of $97 for the three months ended June 30, 2021. Other income is comprised of interest and dividend income of $79 and $3, respectively (three months ended June 30, 2022 - interest and dividend income of $47 and $50, respectively).

Forward Looking Statements

Certain statements herein may be 'forward looking' statements that involve known and unknown risks, uncertainties and other factors that may cause the actual results, performance or achievements of Pinetree or the industry to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Forward-looking statements involve significant risks and uncertainties, should not be read as guarantees of future performance or results, and will not necessarily be accurate indications of whether or not such results will be achieved. A number of factors could cause actual results to vary significantly from the results discussed in the forward-looking statements. These forward-looking statements reflect current assumptions and expectations regarding future events and operating performance and are made as of the date hereof and Pinetree assumes no obligation, except as required by law, to update any forward-looking statements to reflect new events or circumstances.

Non-IFRS Measures, Non-GAAP Measures

BVPS (book value per share) is a non-IFRS (international financial reporting standards) measure calculated as the value of total assets less the value of total liabilities divided by the total number of common shares outstanding as at a specific date. The term BVPS does not have any standardized meaning according to IFRS and therefore may not be comparable to similar measures presented by other companies. There is no comparable IFRS measure presented in Pinetree's consolidated financial statements and thus no applicable quantitative reconciliation for such non-IFRS financial measure. The Company has calculated BVPS consistently for many years and believes that BVPS can provide information useful to its shareholders in understanding its performance and may assist in the evaluation of its business relative to that of its peers.

About Pinetree Capital Ltd.

Pinetree is a value-oriented investment and merchant banking company focused on the technology sector. Pinetree's common shares are listed on the TSX under the symbol 'PNP'.

For further information:

John Bouffard

Chief Financial Officer

416-941-9600 x 200

[email protected]

www.pinetreecapital.com

SOURCE: Pinetree Capital Ltd.

View source version on accesswire.com:

https://www.accesswire.com/711861/Pinetree-Capital-Ltd-Announces-Unaudited-Financial-Results-For-The-Period-Ended-June-30-2022

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Vancouver Star news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Vancouver Star.

More InformationInternational

SectionUS SC judges question California’s power to set rigid emission rules

WASHINGTON, D.C.: This week, U.S. Supreme Court justices seemed open to letting fuel companies challenge California's strict vehicle...

US government fast-tracks energy, mining permits on federal lands

WASHINGTON, D.C.: The Trump administration announced this week that it will create a fast-track approval process for energy and mining...

Israeli prime minister hosts 80 international diplomats

JERUSALEM - More than 80 ambassadors and heads of mission from across the world were addressed by Israeli Prime Minister Benjamin Netanyahu...

US lawmakers subpoena Chinese telecom giants over security fears

WASHINGTON, D.C.: U.S. lawmakers are turning up the heat on China's biggest telecom firms, issuing subpoenas to compel their cooperation...

EU drugmakers demand higher prices to boost innovation

BRUSSELS, Belgium: European pharmaceutical companies are pushing for higher drug prices across the EU, warning that current pricing...

Michigan nuclear plant gets federal funds for historic restart

WASHINGTON, D.C.: A nuclear power plant in Michigan is hoping to become the first in the U.S. to restart after being permanently shut...

Business

SectionUS, India progress toward major trade deal covering 19 sectors

WASHINGTON, D.C.: The United States and India are advancing talks on a wide-ranging trade agreement that would cover 19 key areas,...

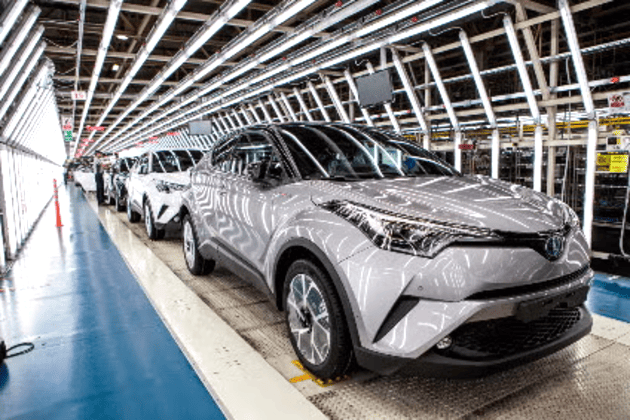

Toyota sets March sales record as North American buyers rush in

TOKYO, Japan: Toyota's overseas sales surged to a new March record, driven largely by a rush of North American buyers ahead of newly...

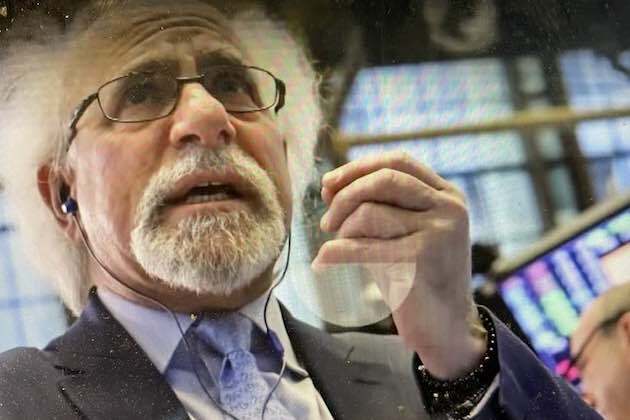

Wall Street on edge, industrials gain while techs slide

NEW YORK, New York - Uncertainty about trade negotiations between the United States and China kept investors and traders on edge Monday...

US new home sales jump as buyers seize lower rates in March

WASHINGTON, D.C.: Sales of new single-family homes in the U.S. rose more than expected in March as buyers rushed to take advantage...

BMW to integrate DeepSeek AI in China models this year

SHANGHAI, China: BMW is set to incorporate artificial intelligence from Chinese startup DeepSeek into its upcoming vehicle models in...

Cathay Pacific braces for cargo slowdown amid China-US trade tensions

Hong Kong: Cathay Pacific Airways is preparing for a slowdown in air cargo traffic between China and the United States as new trade...